📊 Budget Impact on Real Estate Sector in Pakistan – Key Insights

The 2025 federal budget in Pakistan has introduced key measures that are set to influence the real estate sector, creating both challenges and opportunities for investors, developers, and property buyers.

Tax Reliefs and Incentives: The budget has reduced the withholding tax (WHT) on property transactions and abolished the federal excise duty (FED), lowering overall costs for buyers. In Islamabad, stamp duty has been cut from 4% to 1%, making property purchases more affordable. These changes are expected to stimulate market activity, particularly among middle-income buyers.

Affordable Housing Boost: Developers investing in affordable housing projects now enjoy tax incentives, while mortgage support schemes and tax-free credits aim to help middle-income buyers acquire homes. This could drive demand in low- and mid-range property segments.

Regulatory Measures: Non-filers face higher taxes, including capital gains tax, encouraging the formalization of the market. Stricter documentation and transparency measures will curb speculative investments and promote a more stable property environment.

Economic Context: A reduction in interest rates to 11% and easing inflation improves borrowing affordability and investor confidence. However, rising global construction costs due to material tariffs may affect project budgets.

Implications for Stakeholders: Investors should focus on well-documented, compliant transactions and explore affordable housing opportunities. Developers can leverage tax breaks while carefully managing construction costs. Buyers benefit from reduced transaction costs and improved financing options.

Conclusion: The 2025 budget provides incentives that could boost real estate activity, particularly in affordable housing, while stricter regulations and external economic factors require careful planning. Stakeholders must adapt strategies to maximize benefits in this evolving landscape.

🏠 How the Budget Affects Property Prices and Buyer Confidence

One of the most significant effects of the 2025 federal budget on Pakistan’s real estate sector is the shift in property prices due to updated tax policies. The budget introduced changes in Capital Gains Tax (CGT), advance tax on property purchases, and withholding tax slabs, all of which directly influence buyer confidence and seller strategies. For instance, higher CGT rates may initially make investors cautious, while reduced withholding taxes on certain transactions encourage genuine buyers to enter the market.

In many cases, these changes lead to a short-term slowdown in property transactions as both buyers and sellers adjust to the new rules. However, over time, the market tends to stabilize as investors and developers adapt their strategies, ultimately creating a more transparent and balanced environment.

For Karachi DHA, Clifton, and other prime residential areas in Pakistan, these budgetary adjustments can impact property pricing trends, investment returns, and demand patterns. Buyers and investors who understand these shifts can plan better, securing properties at competitive rates while minimizing risk. Developers, on the other hand, can strategize marketing and project launches in response to evolving buyer behavior.

Staying informed about budget impacts is essential for anyone looking to navigate Pakistan’s dynamic real estate market successfully.

At UR Property, we’ve observed that buyers are currently more cautious, but interest remains high in popular areas like DHA, Clifton, and commercial corridors. This is a great time to explore properties for sale or invest in commercial spaces before prices adjust fully to the new tax implications.

🏗️ Developer and Investor Response to Budget 2025

Developers are recalculating costs, especially for ongoing and upcoming projects. The budget’s influence on construction material prices and duties on imports will impact housing supply. However, initiatives like tax incentives for overseas Pakistanis and government housing schemes may encourage long-term growth.

Investors are now focusing on rental income and long-term gains instead of short-term flipping. Many are looking into offices for rent and residential rentals as safer, income-generating options in this transitional phase.

📌 Conclusion: Strategy Is Key Post-Budget

📊 Budget Impact on Real Estate Sector in Pakistan 2025–26

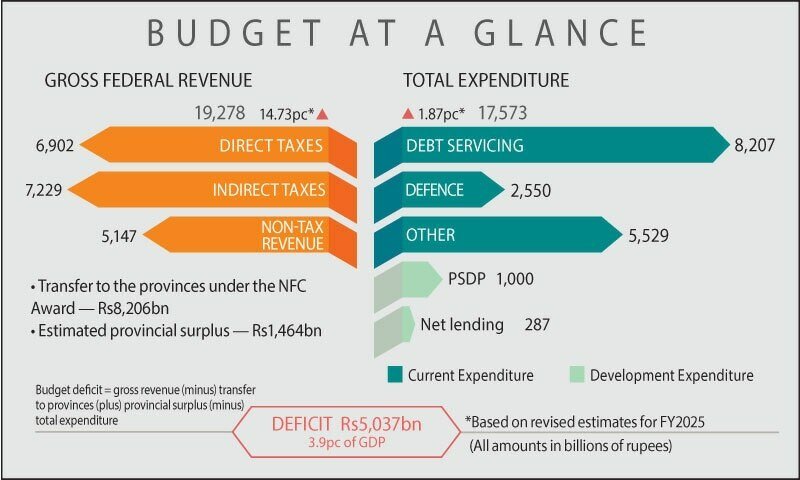

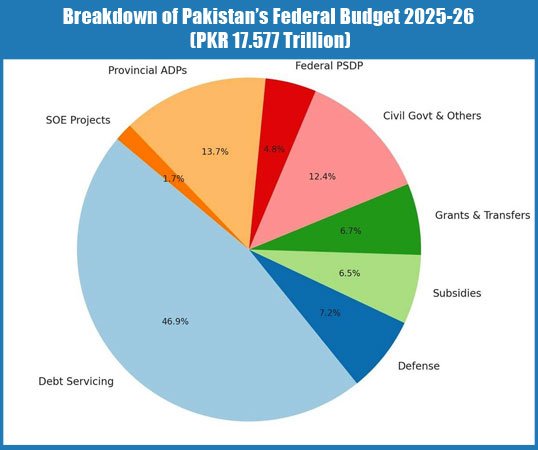

The 2025 federal budget in Pakistan is poised to reshape the real estate sector with a mix of tax reforms and investment incentives. Announced on June 10, 2025, the Rs 17.573 trillion budget introduces policies that directly affect buyers, sellers, and developers. Key measures include adjustments in Capital Gains Tax (CGT), withholding tax on property transactions, and incentives for developers investing in affordable housing projects.

These reforms aim to increase transparency, reduce speculative activity, and encourage genuine investment in residential and commercial properties. For buyers, reduced transaction costs and mortgage support schemes make property acquisition more accessible, while sellers and investors must adapt to the new tax structure to optimize returns. Developers can also benefit from tax breaks and strategic project planning, particularly in high-demand areas like Karachi DHA, Clifton, and Bahria Town.

Overall, the 2025 budget is designed to revive real estate investment momentum, balancing short-term market adjustments with long-term stability. Stakeholders who understand these policy shifts can make informed decisions, seize opportunities, and navigate Pakistan’s evolving property market more confidently.

View the full budget document on the Ministry of Finance’s official site.

🧾 Major Tax Relief for Buyers

To boost the property market, the government has slashed several key taxes:

- Withholding Tax (WHT) reductions:

- Up to Rs 50M → 4% to 2.5%

- Rs 50–100M → 3.5% to 2%

- Over Rs 100M → 3% to 1.5%

- Federal Excise Duty (FED) removed on property transfers

- Stamp Duty in Islamabad cut from 4% to 1%

These adjustments directly reduce the upfront costs for buyers, encouraging more legal and transparent real estate transactions.

🏗️ Incentives for Developers and Affordable Housing

The 2025–26 federal budget’s influence extends beyond property transactions to Pakistan’s construction sector. New policies are designed to encourage both affordable housing and commercial development, creating growth opportunities for developers and investors alike. Tax incentives and reduced duties for developers focusing on low- and mid-range housing projects are expected to boost construction activity in key areas such as Karachi DHA, Clifton, and emerging urban centers.

For commercial construction, the budget provides cost advantages and regulatory support that make new projects more viable, attracting investment in office spaces, retail complexes, and mixed-use developments. By promoting transparency and formalization, these measures also aim to reduce speculative practices, ensuring that construction projects are both sustainable and profitable.

Ultimately, the 2025–26 budget reinforces the link between real estate and construction, providing a favorable environment for developers, buyers, and investors to participate in Pakistan’s growing property market.

- Tax exemptions for flats under 2,000 sq ft and homes up to 10 marlas

- New mortgage schemes for middle-income buyers

- FBR-imposed rent cap of 4% on commercial leases to lower operating costs

These changes reduce development costs and improve access to housing, especially for first-time buyers.

📉 Penalties for Non-Filers and Sellers

To discourage undocumented investments, the budget introduced tougher compliance regulations:

- Seller WHT raised to up to 5.5%

- Non-filers face 18.5% tax on purchases

- Property transactions banned for non-filers from mid-2025 onward

This will likely slow speculative buying but will increase transparency and formal sector growth.

📈 Market Trends Backed by Data

Based on post-budget data and published charts:

- Increased activity in mid-income housing projects

- Stable growth in commercial zones like DHA and Clifton

- A drop in speculative investments in luxury properties

- Surge in interest for properties for rent and affordable housing projects

📌 Conclusion: Plan Your Investment Wisely

The 2025–26 federal budget creates significant opportunities for those who plan strategically. Buyers stand to benefit from reduced taxes and lower transaction costs, making property purchases more affordable. Developers can leverage tax incentives and cost advantages to optimize project profitability, particularly in residential and commercial sectors. Meanwhile, investors who comply with new regulations and maintain proper documentation will thrive in a more formalized and transparent market.

At UR Property, we help you navigate these post-budget opportunities and make informed decisions in Pakistan’s dynamic real estate landscape. Our focus includes prime locations like Karachi DHA, Clifton, Bahria Town, and other high-demand areas. Whether you are looking to buy, sell, or invest, understanding the budget’s impact on property prices, Capital Gains Tax (CGT), and withholding taxes is key to maximizing your returns.

Explore how you can benefit from the 2025–26 budget with UR Property and position yourself for success in Pakistan’s evolving real estate market.

- Residential Projects

- Commercial Offices

- Investment Plots

- Rental Properties

👉 Visit UR-Property.com to explore listings and connect with a trusted agent.