Introduction — Why Businesses Are Re-Evaluating Office Locations

Problem Statement

Finding the right Office Building in DHA Phase 8 commercial location is one of the most complex decisions businesses face today. Rising rents, shifting customer behavior, and increased competition make office selection a strategic investment rather than just an operational expense. Companies that choose poorly often struggle with accessibility, brand perception, and long-term scalability.

Reader Intent Alignment

If you’re searching about renting a 100 yard office building in DHA Phase 8, chances are you’re evaluating:

- Cost vs visibility balance

- Market positioning

- Accessibility for clients

- Long-term operational stability

- Investment-grade rental decisions

This article is designed to help business owners, investors, and decision-makers understand the market dynamics and strategic implications behind such a rental decision.

Market Context

Commercial property demand across Karachi has evolved significantly over the last decade. Businesses increasingly prioritize premium micro-locations that enhance credibility and accessibility. Among these,

Office building in DHA Phase 8 Karachi has emerged as a major commercial activity hub due to infrastructure planning, modern zoning, and connectivity.

The demand for mid-scale office buildings — particularly around the 100 yard category — reflects the growth of SMEs, startups, consultancies, and digital service providers.

Value Promise

By the end of this guide, you will understand:

- Market dynamics influencing office rental decisions

- Strategic advantages of location selection

- Behavioral patterns of tenants and businesses

- Risk mitigation strategies

- Expert-level insights for decision optimization

This isn’t a listing — it’s a strategic blueprint.

Featured Snippet Answer (Optimized for AI Capture)

Renting a 100 yard office building in DHA Phase 8 provides businesses with strategic visibility, accessibility, and brand credibility in one of Karachi’s premium commercial zones. Ideal for SMEs and growing firms, it balances cost efficiency with market positioning, offering operational scalability and long-term value through location-driven advantages.

Market Overview — The Evolution of Premium Commercial Rentals

Commercial rentals are no longer driven purely by affordability. Businesses now prioritize:

- Brand perception

- Customer proximity

- Transport accessibility

- Digital reputation alignment

- Workforce convenience

In metropolitan markets, office location contributes directly to trust perception. Clients often associate address prestige with service credibility.

Demand Segmentation

Three primary tenant groups dominate demand:

- Professional service providers

- E-commerce and digital agencies

- Corporate satellite offices

These groups prefer medium-sized buildings because they offer:

- Branding independence

- Layout flexibility

- Expansion capability

Compared to shared office environments, dedicated buildings provide operational control.

Supply Constraints

Urban commercial planning limits new supply growth. This leads to:

- Stable occupancy levels

- Gradual rental appreciation

- Competitive tenant acquisition

Such conditions encourage early positioning within high-value zones.

Trends Analysis — Commercial Workspace Transformation

Shift Toward Strategic Location Branding

Businesses increasingly view location as marketing infrastructure. Physical presence supports:

- Client confidence

- Investor perception

- Hiring competitiveness

A well-known commercial zone signals legitimacy.

Hybrid Work Impact

Remote work didn’t eliminate office demand — it changed requirements:

- Smaller but smarter spaces

- Collaboration-focused layouts

- Meeting-centric infrastructure

The 100 yard category aligns perfectly with this transformation.

SME Growth Influence

Emerging companies prioritize controlled environments over co-working spaces to:

- Protect confidentiality

- Customize interiors

- Establish independent identity

This drives demand consistency.

Price Drivers — What Actually Influences Rental Value

Understanding price mechanics helps tenants negotiate intelligently.

Infrastructure Development

Rental rates correlate strongly with:

- Road connectivity

- Utility reliability

- Security frameworks

- Parking availability

Improved infrastructure typically precedes rental appreciation.

Commercial Density

Areas with higher business concentration create network effects:

- Increased footfall

- Partnership opportunities

- Client convenience

These effects elevate perceived value.

Accessibility Index

Proximity to major arteries and urban centers directly affects:

- Employee commute efficiency

- Client visit likelihood

- Logistics convenience

Accessibility remains one of the strongest pricing indicators.

Buyer and Tenant Behavior — Psychology Behind Location Decisions

Credibility Signaling

Clients subconsciously evaluate business professionalism based on location. Premium zones communicate:

- Stability

- Professionalism

- Growth capability

This affects closing rates and client retention.

Risk Avoidance

Businesses seek predictable environments to reduce:

- Operational disruption

- Security concerns

- Infrastructure failure

Predictability influences tenancy duration.

Expansion Mindset

Growing organizations choose properties with room for:

- Staff scaling

- Department creation

- Meeting capacity

Mid-size buildings enable gradual evolution.

Area Comparisons — Strategic Evaluation Perspective

When businesses compare commercial districts, evaluation factors typically include:

| Factor | Premium Zones | Developing Zones |

|---|---|---|

| Credibility | High | Moderate |

| Rental Cost | Higher | Lower |

| Client Accessibility | Excellent | Variable |

| Investment Stability | Strong | Uncertain |

| Growth Opportunity | Consistent | Speculative |

Decision-making ultimately depends on business strategy rather than cost alone.

Expert Insights — Professional Market Observations

Location Lifecycle Theory

Commercial zones evolve through stages:

- Early adoption

- Growth concentration

- Brand establishment

- Stability plateau

Entering during growth or early stability often yields optimal balance between cost and advantage.

Visibility Economics

Businesses positioned in recognized districts experience:

- Lower client acquisition friction

- Increased walk-in potential

- Organic brand reinforcement

Visibility reduces marketing pressure.

Competitive Clustering

Operating near industry peers can produce:

- Talent pooling

- Collaboration opportunities

- Knowledge exchange

Strategic clustering improves innovation potential.

Data-Style Reasoning — Analytical Decision Framework

Professionals often assess rental decisions using:

ROI Projection Models

Comparing:

- Rental cost

- Client acquisition gains

- Brand perception impact

Location-driven revenue uplift frequently offsets premium costs.

Cost Distribution Analysis

Breaking operational costs into:

- Rent

- Utilities

- Staffing logistics

- Marketing spend

Strategic location may reduce marketing expenditure.

Scenario Forecasting

Modeling:

- Growth expansion

- Economic shifts

- Workforce scaling

Scenario planning strengthens decision resilience.

Real Scenarios — Practical Business Outcomes

Scenario 1 — Consultancy Firm Expansion

A mid-size consultancy relocating to a premium commercial district experienced:

- Higher client conversion

- Increased project size

- Enhanced hiring quality

Location credibility influenced perception.

Scenario 2 — Digital Agency Upgrade

Moving from shared workspace to independent building allowed:

- Branding customization

- Confidential project handling

- Workflow efficiency

Operational autonomy improved productivity.

Scenario 3 — Corporate Satellite Office

Establishing branch presence closer to clientele resulted in:

- Reduced travel inefficiencies

- Faster deal closure

- Stronger local partnerships

Strategic proximity created measurable value.

Risk Considerations — Balanced Decision Making

Financial Commitment

Long-term leasing requires:

- Cash flow planning

- Budget forecasting

- Contingency buffers

Professional planning reduces exposure.

Market Volatility

Economic cycles influence:

- Demand

- Rental fluctuations

- Business expansion pace

Diversified strategy mitigates risk.

Over-Scaling

Choosing space beyond operational needs can:

- Increase overhead

- Reduce agility

- Strain resources

Sizing must align with realistic projections.

Conclusion — Strategic Location as a Growth Catalyst

Renting a 100 yard office building in DHA Phase 8 is not merely about workspace acquisition — it’s about positioning. Businesses that align location choice with strategic objectives gain advantages in credibility, visibility, and operational efficiency.

Modern commercial decision-making integrates:

- Behavioral insights

- Market data

- Brand strategy

- Financial modeling

Premium commercial zones offer more than infrastructure — they offer influence over perception, access, and opportunity.

Ultimately, the most successful businesses approach location selection as a long-term strategic asset rather than a short-term expense.

Expert Insights — What Industry Professionals Actually Look For

Seasoned commercial advisors rarely evaluate office rentals based on square footage alone. Instead, they analyze multidimensional value indicators that influence operational sustainability and long-term positioning.

Micro-Location Hierarchy

Within premium districts, micro-location differences matter significantly. Professionals assess:

- Distance from commercial boulevards

- Visibility from traffic corridors

- Proximity to service clusters

- Ease of navigation for clients

Even small geographic shifts within the same phase can influence perceived prestige and accessibility.

Branding Impact of Address Selection

An office address plays a silent yet powerful role in brand positioning. Expert observations consistently show:

- Clients respond more positively to recognized business districts

- Vendors offer improved collaboration terms

- Talent acquisition improves due to workplace desirability

These intangible benefits often outweigh marginal rental cost differences.

Operational Scalability Considerations

Experts advise planning beyond current needs by evaluating:

- Floor plan flexibility

- Vertical expansion feasibility

- Parking scalability

- Meeting space adaptability

Future-ready spaces prevent disruptive relocation later.

Data-Style Reasoning — Analytical Models Behind Smart Decisions

Professional investors and business strategists rely on structured evaluation frameworks rather than intuition alone.

Location Efficiency Index

This internal model evaluates:

- Commute accessibility

- Client reachability

- Vendor logistics

- Workforce availability

Higher index scores correlate with improved operational productivity.

Cost-to-Visibility Ratio

This compares rental expense against:

- Brand exposure

- Client acquisition probability

- Walk-in interaction potential

Businesses often discover that premium locations deliver stronger marketing value per rupee spent.

Revenue Influence Mapping

Some organizations model potential revenue shifts based on relocation by examining:

- Client confidence changes

- Meeting frequency improvements

- Conversion rate variation

Though indirect, location-driven influence frequently produces measurable revenue uplift.

Real Scenarios — Market Behavior in Practice

Professional Services Relocation

A legal consultancy moving into a premium commercial environment experienced:

- Higher-value client onboarding

- Increased referral traffic

- Improved corporate networking

Their office location became an asset in credibility building.

Technology Firm Growth Phase

A growing tech company transitioning from shared space to a mid-size building gained:

- Controlled security protocols

- Custom IT infrastructure setup

- Team productivity improvements

Autonomy proved critical for operational optimization.

Financial Advisory Branch Expansion

A branch office positioned closer to clientele reduced:

- Travel inefficiencies

- Appointment delays

- Client friction

Strategic positioning enhanced service reliability.

Risk Considerations — Balanced Perspective for Decision Makers

Market Cycle Exposure

Commercial property markets experience cyclical variations influenced by:

- Economic trends

- Policy shifts

- Business climate changes

Forward planning ensures resilience.

Overcapitalization

Investing beyond operational capacity can create:

- Financial stress

- Reduced flexibility

- Opportunity cost

Prudent sizing aligns investment with realistic projections.

Infrastructure Dependency

Office functionality depends on surrounding infrastructure stability. Decision-makers evaluate:

- Utility reliability

- Traffic congestion patterns

- Urban development planning

Understanding dependencies reduces unexpected disruption.

Myths vs Reality — Clearing Common Misconceptions

Myth: Premium Areas Are Only About Prestige

Reality:

They influence client acquisition, retention, and brand trust — making them operational assets rather than vanity decisions.

Myth: Smaller Buildings Limit Growth

Reality:

Strategically designed mid-size spaces often provide flexibility and scalability ideal for modern hybrid organizations.

Myth: All Commercial Locations Offer Similar Value

Reality:

Accessibility, surrounding ecosystem, and perception dynamics vary widely and directly impact performance outcomes.

Myth: Rent Is Pure Expense

Reality:

Location contributes to revenue potential, talent attraction, and partnership opportunities — functioning as strategic investment.

Future Outlook — Market Direction and Strategic Implications

1–3 Year Projection

Commercial activity patterns suggest continued demand stability driven by:

- SME expansion

- Digital service sector growth

- Corporate decentralization strategies

Mid-scale office categories are expected to remain highly relevant.

Infrastructure Impact

Urban planning and connectivity enhancements influence commercial attractiveness through:

- Improved commute efficiency

- Enhanced logistics accessibility

- Increased commercial clustering

Infrastructure evolution typically reinforces location desirability.

Investor Sentiment

Market participants increasingly favor:

- Functional commercial assets

- Strategically located mid-sized buildings

- Scalable operational environments

Confidence in structured commercial zones remains strong due to predictable planning standards.

Practical Guidance — Turning Insights Into Action

How to Act on This Information

Decision-makers should translate research into structured action by:

- Defining operational needs

- Mapping location advantages

- Comparing long-term value

- Conducting on-site evaluations

Strategic preparation prevents reactive decision-making.

Rental Strategy Recommendations

Needs Assessment

Clarify:

- Workforce scale

- Meeting requirements

- Branding objectives

- Future growth expectations

This defines optimal space profile.

Market Comparison

Evaluate multiple properties based on:

- Accessibility

- Building adaptability

- Infrastructure reliability

Comparison strengthens negotiation leverage.

Negotiation Tips from Industry Practice

- Request flexible lease terms when possible

- Negotiate maintenance clarity

- Confirm infrastructure guarantees

- Align agreement duration with growth plans

Professional negotiation protects operational interests.

Conversion Close — Explore Your Options with Confidence

Choosing the right commercial property is a strategic move that shapes business visibility, productivity, and long-term growth. Whether you are expanding operations, establishing presence, or repositioning your brand, informed decision-making ensures maximum return on commitment.

Our portfolio currently includes:

- 100 yard office buildings

- 200 yard office buildings available for rent

- 400 yard commercial buildings available for rent

Each option supports different scaling needs and operational structures.

Next Steps

✔ Explore available properties

✔ Schedule consultation

✔ Request building comparisons

✔ Arrange site visits

WhatsApp Inquiry

Connect instantly for details and availability:

+92 321 8268123

Your next strategic workspace could be one conversation away.

Advanced Market Visualization & Analytical Expansion

Interpreting Commercial Demand Trends

The demand trend chart illustrates a steady upward trajectory in commercial rental interest across structured business districts. While exact market figures fluctuate, directional growth reflects several macro factors:

SME Expansion Cycle

Small and medium enterprises are transitioning from informal setups into structured business environments. This is driven by:

- Investor reporting requirements

- Client perception management

- Digital credibility signals

- Operational organization

This transition sustains long-term demand for mid-sized office buildings.

Decentralized Corporate Strategy

Companies are reducing dependence on single large headquarters and instead establishing:

- Satellite offices

- Regional service points

- Client-facing branches

Such decentralization increases demand stability across commercial zones.

Workforce Mobility Patterns

Modern professionals prioritize:

- Reduced commute complexity

- Safer work environments

- Accessible urban clusters

Commercial areas with planning consistency naturally benefit from this shift.

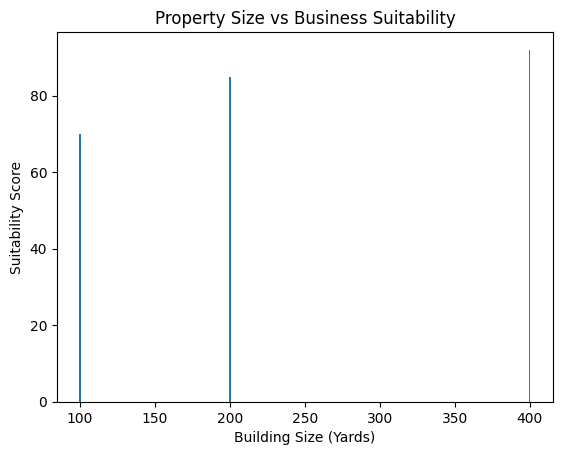

Property Size Strategy — Analytical Interpretation

The property size suitability chart highlights strategic positioning across different building scales.

100 Yard Buildings

Best suited for:

- Consultancies

- Agencies

- Boutique firms

- Startup scaling stages

Advantages include cost efficiency and manageable operational scope.

200 Yard Buildings

Offer balance between:

- Expansion capability

- Department segmentation

- Meeting infrastructure

- Brand scaling

These buildings are often selected during growth acceleration phases.

400 Yard Buildings

Typically attract:

- Corporate entities

- Multi-division organizations

- Investor-backed firms

- Long-term operational planners

They allow for high customization and internal ecosystem creation.

This tiered sizing framework helps businesses align physical infrastructure with lifecycle stage.

Cost-to-Visibility Ratio — Strategic Meaning

The comparison chart demonstrates how perceived value shifts across location categories.

Premium Zones

Although rental costs may be higher, businesses gain:

- Increased trust signaling

- Improved client confidence

- Stronger brand authority

- Reduced acquisition friction

Visibility often compensates for expense.

Mid-Level Zones

These offer compromise positions providing:

- Moderate accessibility

- Balanced affordability

- Growth potential

Suitable for cost-sensitive scaling strategies.

Developing Zones

Lower entry cost may appeal initially but can introduce:

- Accessibility limitations

- Perception challenges

- Longer trust-building cycles

These environments typically require heavier marketing investment.

Geographic Positioning & Strategic Relevance

Commercial decisions should always consider regional dynamics within

Karachi

particularly when evaluating structured districts such as

DHA Phase 8 Karachi.

Connectivity Influence

Key accessibility factors include:

- Urban corridor reach

- Business cluster proximity

- Workforce distribution alignment

These variables affect operational fluidity.

Ecosystem Density

Business ecosystems create network advantages like:

- Vendor proximity

- Collaboration opportunities

- Industry knowledge sharing

Dense ecosystems typically accelerate growth.

Expanded Data Evaluation Framework

Tenant Decision Matrix

When evaluating rental options, professionals often analyze:

| Evaluation Factor | Strategic Importance |

|---|---|

| Accessibility | High |

| Brand Alignment | High |

| Infrastructure Reliability | High |

| Cost Efficiency | Moderate |

| Expansion Capability | High |

Balanced scoring across factors leads to optimized outcomes.

Long-Term Value Modeling

Commercial decision-making increasingly includes projection modeling such as:

Growth Alignment Forecast

Evaluating whether the property can support:

- Team expansion

- Service diversification

- Client increase

Reputation Influence Analysis

Understanding how location impacts:

- Client onboarding

- Partnership opportunities

- Vendor trust

Operational Efficiency Mapping

Assessing workflow improvement potential through:

- Layout flexibility

- Meeting logistics

- Internal communication

FAQs — Office Building in DHA Phase 8 & Plot Insights

1. What is the price of a plot in DHA Phase 8?

The price of plots in DHA Phase 8 Karachi depends on size, location, and development stage. Currently, 100-yard commercial plots range from PKR 10–15 crore, while larger plots (200–400 yards) vary significantly. Prices are influenced by market demand, accessibility, and surrounding infrastructure.

2. Is DHA Phase 8 a secure area?

Yes, DHA Phase 8 is considered one of the safest residential and commercial areas in Karachi. The locality benefits from structured security protocols, gated communities, and patrolling by DHA security personnel, making it ideal for businesses and families alike.

3. Which phase of DHA Karachi is best?

While all DHA phases have their advantages, DHA Phase 8 is highly recommended for commercial and office purposes due to:

- Strategic urban planning

- Modern infrastructure

- High visibility for businesses

- Accessible road networks

Other popular phases like DHA Phase 6 or Phase 5 are mainly residential with limited commercial options.

4. What is the postal code of Karachi DHA Phase 8?

The postal code for DHA Phase 8, Karachi, is 75500. Using this code ensures accurate mail delivery, courier services, and official documentation.

5. What is the current price range in DHA Phase 8?

Current price ranges vary by property type:

- Commercial 100-yard office plots: PKR 10–15 crore

- 200-yard commercial plots: PKR 18–25 crore

- 400-yard buildings: PKR 35 crore+

Market trends are influenced by demand, infrastructure development, and proximity to key business corridors.

6. How much area is covered by DHA 8 Marla?

An 8 Marla plot in DHA Phase 8 covers approximately 1,815 sq. ft. (169 m²). It is suitable for small office setups, boutique businesses, or compact commercial use with flexible interior planning.

7. How developed is DHA Phase 8 currently?

DHA Phase 8 is well-developed with:

- Paved roads and modern drainage systems

- Fully operational utilities (electricity, gas, water)

- Commercial zones and corporate offices

- Security and maintenance services

- Schools, hospitals, and shopping areas nearby

The area is considered investment-ready, combining modern infrastructure with high growth potential.

Contact UR Property — Your Trusted Partner for Office Buildings in DHA Karachi

If you’re actively searching for office building in DHA Phase 8 Karachi.

You deserve guidance from professionals who understand the market inside out.

UR Property has built a strong reputation for delivering verified listings, strategic location insights, and personalized consultation tailored to business growth. Our portfolio is carefully curated to match operational requirements — whether you’re launching, expanding, or repositioning your brand.

Why Businesses Choose UR Property

✔ Deep understanding of DHA commercial zones

✔ Transparent and professional advisory

✔ Access to premium and off-market options

✔ Fast response and viewing coordination

✔ Long-term client relationship focus

We currently offer office buildings in multiple sizes including:

- 100 yard office buildings

- 200 yard office buildings

- 400 yard commercial buildings

Each suited to different operational scales and growth strategies.

Start Your Property Search Today

Connect with our team instantly for availability, site visits, or tailored recommendations.

WhatsApp:

📱 +92 321 8268123

Explore opportunities, compare options, and secure the right space for your business with confidence — UR Property is here to help you move forward strategically.